What is a Value Trap ... and How do I avoid them?

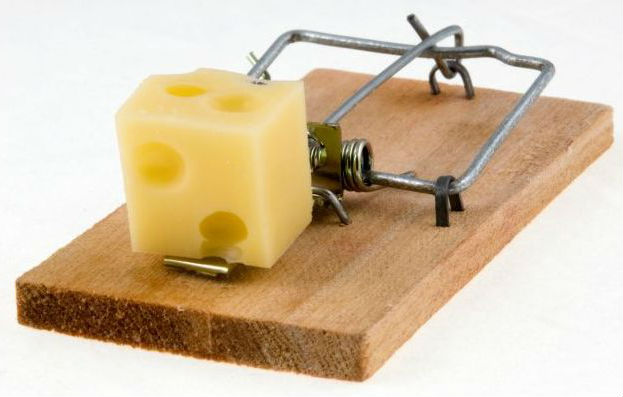

Investors speak of falling into a "value trap" when they buy a stock that looks cheap on traditional valuation measures such as having a low price/earnings ratio, a low price/book ratio or a high dividend yield, but the cheap valuation is actually a reflection of problems in the business.

These types of investments usually turn out to be a poor (or disastrous!) investment. Value investors often look for companies that are "cheap" but when is "cheap" ... "bad"?

Value trap #1 - low price/earnings ratio

A low price/earnings (P/E) ratio can signal an undervalued stock but it can also be a value trap. Why is this?

This is because the P/E ratio you see is usually historical which means the ratio uses last year's earnings as the denominator. The stock price, however, will usually move in expectation of future earnings and so a very low P/E ratio can mean that earnings are about to tumble and so the stock isn't actually that cheap.

You should be aware of the shortcomings of the P/E ratio as this can help you avoid the trap. Things to watch out for are expected changes in earnings (as mentioned above), cyclical businesses, a one off event that causes earnings to spike or plummet.

What you should try to assess as an investor is the long term earning POWER of the business. For example, a huge one off fine is going to hurt earnings enormously in one year but shouldn't have a long term effect as long as the long term reputation of the business remains intact. In many ways, a one off fine like this is like a business paying a one off special dividend.

We've written about the P/E ratio here.

Value trap #2 - low price/book value

Some investors look for companies that trade on a low price/book (P/B) ratio as they feel that if they can buy the company below the value of the net assets (i.e. below book value) then they are getting a good deal.

This may or may not be true, but like the P/E ratio above, it is worth exploring why a stock might be trading on a low P/B ratio.

Firstly you need to decide how accurate the reported book value of the company is. Remember that book value is the value of total assets - total liabilities. This is also sometimes known as equity.

Ben Graham said in his terrific book "Security Analysis" that the investor should remember that liabilities can't be written down (for there to be equity value), yet assets can be written down.

You should be particularly wary of non-current assets and intangible assets. Intangible assets such as goodwill are often written down when an asset starts underperforming which means the book value will go down and the "bargain" you thought you had was not such a bargain.

We've written more about this here.

Value trap #3 - high dividend yield

The investor should be vary wary of stock with high dividend yields. If you aren't careful you could fall into the dividend trap.

The dividend trap is very similar to the value trap in that the dividend yield is often based on the historic dividend and a very high yield means the market could be pricing in a dividend cut that's on its way.

There are various things you can look for to protect yourself from the dividend trap.

Remember that dividends are paid from cash, so you should analyze the cashflow statement and make sure there is plenty of free cash being generated to cover the current dividend. You may also want to check the dividend cover and the strength of the balance sheet.

How to know whether a stock is cheap or a "value trap"...

You can have a major advantage as an investor if you can successfully distinguish between a stock that is cheap or one that is a value trap.

Often a genuinely cheap stock will be going through temporary problems which means it may look cheap on the measures above whilst those temporary events are hurting the business.

A business that is going through structural or more permanent problems may well be a value trap as it may never be able to recover its previous earning power or grow the business as successfully in the future.

|

"Avoiding value traps can be a real challenge but there are some tips we can give based on some good and bad experiences we've had. Firstly, you should try to work out if the business is going through temporary or permanent problems. This isn't easy and will often take your own judgement. Temporary problems may include reversable decisions in the business, fines, or losses that are unlikely to reoccur. Permanent problems can be a changing underlying market, or more competition in the sector. Secondly, you need to try and focus on the long term earning power of the business. This may mean looking at the earnings and performance of the business through many years and at least one full economic cycle. This should give you an indication of how earnings can be maintained in bad times. My final tip is to focus on the balance sheet. A strong balance sheet that has limited or no debt (along with a capable management) should mean the business is far more flexible and able to respond to problems. Good luck!" |

|

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.