The "Dividend Trap"

If you invest with a heavy emphasis on dividends, then the "dividend trap" is something you need to be wary of.

This page examines exactly what that is and takes you through some strategies to spot and avoid them.

|

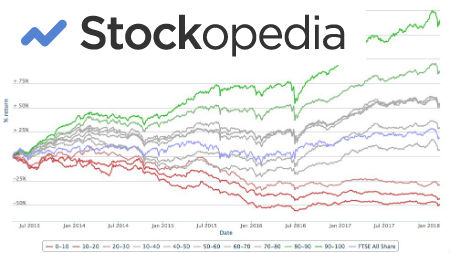

"If something sounds too good to be true then it probably is." It can be very tempting just to scan down a page of stocks and pick the ones with the highest yields. This could be a serious mistake, though! We'd all love a stock that gives a double digit initial yield but this could be a serious red flag. It may be be a dividend trap meaning the dividend is not sustainable. |

|

When can a dividend trap occur?

When the price of the stock falls giving the impression that the yield is high, it's time to be on your guard. This might be a dividend trap.

If the stock of ABC Plc was at $100 and it was paying $4 per share in dividends, then the yield would be 4% but if the stock suddenly dropped to $50 per share then the yield would jump up to 8%.

When the stock drops the market could be pricing in a dividend cut or even an elimination of a dividend.

For example, if you had looked at Pfizer (PFE) in early 2009, you would have seen it with a dividend yield of around 11%. This was a stock that had not cut its dividend for 29 years and was a dividend aristocrat. This was, however, a trap as Pfizer had just made a large acquisition (Wyeth) and was struggling to sustain the dividend. By the summer of 2009, it cut its dividend by 50%.

Remember the market will not give you a free lunch and you need to approach every investment decision with a healthy degree of scepticism.

As Howard Marks says in his excellent book "The Most Important Thing", you should "Invest Scared." You should always be asking questions about what can go wrong and adopt a defensive mindset. This can help you avoid and examine potential dividend traps.

If you see a high yield (say above 5%), you need to examine it before deciding if it is sustainable. The first thing is to check the dividend payout ratio (also known as the "dividend cover"). If this is very thin then a cut could be on the way.

Even if the dividend payout ratio is low, this doesn't necessarily mean the dividend is safe. Remember that earnings can be deceptive and volatile, especially in the short term. You should check the earnings over several years to see if you can assess the sustainable earning power of the business.

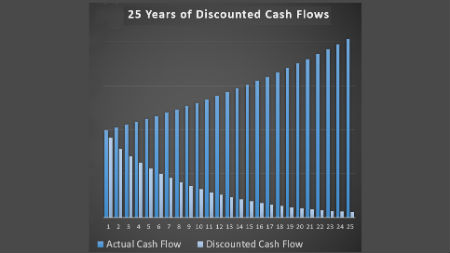

More importantly, you should remember that it is harder to fake the cashflows. Have a look at the company's cashflow statement to examine how sustainable the dividend is.

On our page on dividend safety, we talked about the importance of free cashflow which looks at the amount of cash that is left over for shareholders after capital expenditure has been spent. On that page we had a look at Pepsico's free cashflow. If the free cashflow comfortably covers the dividend payments, then the dividend should look more sustainable.

Always remember that a company does not have to pay a dividend.

If a company misses a coupon payment on a bond or an interest payment then it may go into bankruptcy. A dividend payment, however, is voluntary and if there is not a lot of cash around the dividend can be cut or eliminated to keep the company afloat.

Does a dividend cut or a dividend trap mean a bad investment?

Not necessarily! The market can often not be forgiving if they think a company is about to cut its dividend.

Often the share price will get hammered and by the time you see it is a dividend trap the stock could actually be very cheap, even if it hasn't yet gone ahead and cut the dividend.

One of the greatest investors of all time was Walter Schloss. He said he would sometimes look for companies that had cut their dividends as this meant they might be selling very cheap. You can read about Schloss and his investing style here: http://www.gurufocus.com/news/138200/walter-schloss-the-essence-of-value-investing.

A dividend trap may mean a dividend cut is on its way but it doesn't necessarily mean it will be a bad example.

Back to the Pfizer example from earlier: If you had purchased Pfizer stock on the day they announced the dividend cut in 2009 then you could have purchased stock at around $16.70. They even went below $12 per share in March 2009.

Right now - May 2018 - Pfizer stocks stand at $36 per share and the dividend has fully rebounded beyond its pre-crisis level.

The quarterly dividend was cut from $0.32 per share to $0.16 per share and is now up to $0.34 per share. Purchasing Pfizers shares in early 2009 would have been a very shrewd move even if though you'd have had to have stomached a large dividend cut in the meantime.

Investing is not easy. If it was then everyone would make a fortune doing it. There are dividend traps out there that can signal serious problems but (as shown above) they can lead to substantial opportunities.

Every case is unique and needs to be examined on its own merits. Even then, events and the future are unpredictable and will be out of your control.

We would only really have interest in investing in dividend trap stocks if the company had very low (or no) debt levels and we thought earnings could recover i.e. if the cause of the dividend cut was a cyclical or temporary problem rather than a structural issue (i.e. something seriously wrong with the business' model).

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.

What Other Visitors Have Said

Click below to see contributions from other visitors to this page...

dividend traps

Your explanations on dividend traps is very interesting.

We are considering to buy BOQ waiting patiently at $8.61 and we will accept the dividend 0.68 …