What are the advantages of ETFs?

Much has been made of the advantages of ETFs over stocks for the part-time investor. Many rookie investors can find it intimidating to know where to start. Should you look at stocks? Bonds? Funds? ETFs?

Today, we look at the latter and specifically consider the advantages of ETFs. Here are some reasons why you may favour ETFs over other investment options:

Advantages of ETFs #1

You get immediate diversification

If you have a smaller portfolio then (say under $30,000), it can be very difficult to get adequate diversification by investing in single stocks. This is because it is very inefficient from a cost (and time!) perspective to purchase small sizes of stock. If you are only investing $1,000 in a security and the dealing charge is $15, then you are immediately losing 1.5%. That could be almost a years worth of dividends. Do that 10 times over and the costs are very punitive compared to making one investment in an ETF like the SPDR S&P 500 ETF (SPY) which aims to track the S&P 500.

ETFs can also be useful to get quick diversification in your overall portfolio. For example, you may have built up a large stock portfolio but all your stocks are listed in the US. ETFs can help you quickly get broad diversification in other geographies or currencies and maybe a useful tool when you are less likely to be as familiar with stocks in another jurisdiction.

Advantages of ETFs #2

Fees and trading costs can be very low

ETFs also tend to have very low running costs. This is especially true when you compare their costs to mutual funds. Many mutual funds have expense ratios running at close to 1%. Many ETFs are far cheaper.

For example the expense ratio of the SPY ETF is currently 0.09%. The expense ratio on the Vangard equivalent (VOO) is currently 0.04%.

These differences in expense ratios may not sound like much but can make a big difference to your wealth in the long run. If you invest $5,000 and earn 11% per year then you'll have around $115,000 after 30 years. If you earn 1% less then you'll "only" end up with $87,000 which is around 25% less.

We discuss this extensively on our page on compound interest. As Jeremy Siegel comments "Every extra percentage point of annual costs requires investors aged 25 to retire 2 years later than they would have in the absence of such costs."

Advantages of ETFs #3

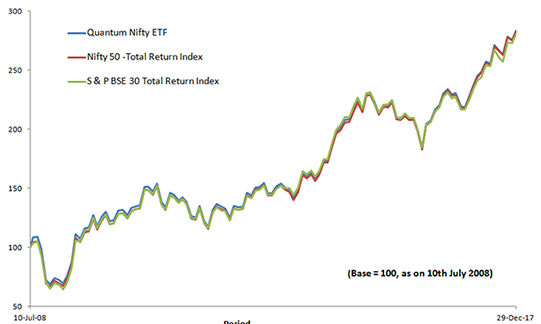

You can easily track the market

Matching the market - that may not sound great, right? Well I think you'd be surprised at just how good that is. By definition the performance of all market participants together must equal the market rate. Once you add in costs then most mutual funds underperform the market over time. You can beat most fund managers by simply buying an index tracker ETF.

Also remember that, over time, stocks tend to perform very well in aggregate. Stocks in the US have had a compound annual total return of around 11% per year since World War II and around 6.5% in real (after inflation) returns.

To quote Jeremy Siegel once again: "A 6.5 percent annual real return, which includes reinvested dividends, will nearly double the purchasing power of your stock portfolio every decade. If inflation stays within the 2 to 3 percent range, nominal stock returns will be 9 percent per year, which doubles the money value of your stock portfolio every eight years."

...not bad for simply buying one single ETF.

Advantages of ETFs #4

You don't need to do much work

If the thought of trawling through numerous annual reports, 10-ks, 8-ks, and trade journals terrifies you (or you have more to do with your life!) then simply buying an index or sector through an ETF should be a very attractive proposition to you.

As mentioned above, you can beat most fund managers by just buying the index and then you can sit back and not do anything.

Doesn't sound bad does it? As long as you can ride out the regular (and sometimes big!) market fluctuations then you'll probably find it less stressful as well.

Hey - we're all for beating most professionals without doing any work. I just wish I could find a way of doing that with my golf game!

Advantages of ETFs #5

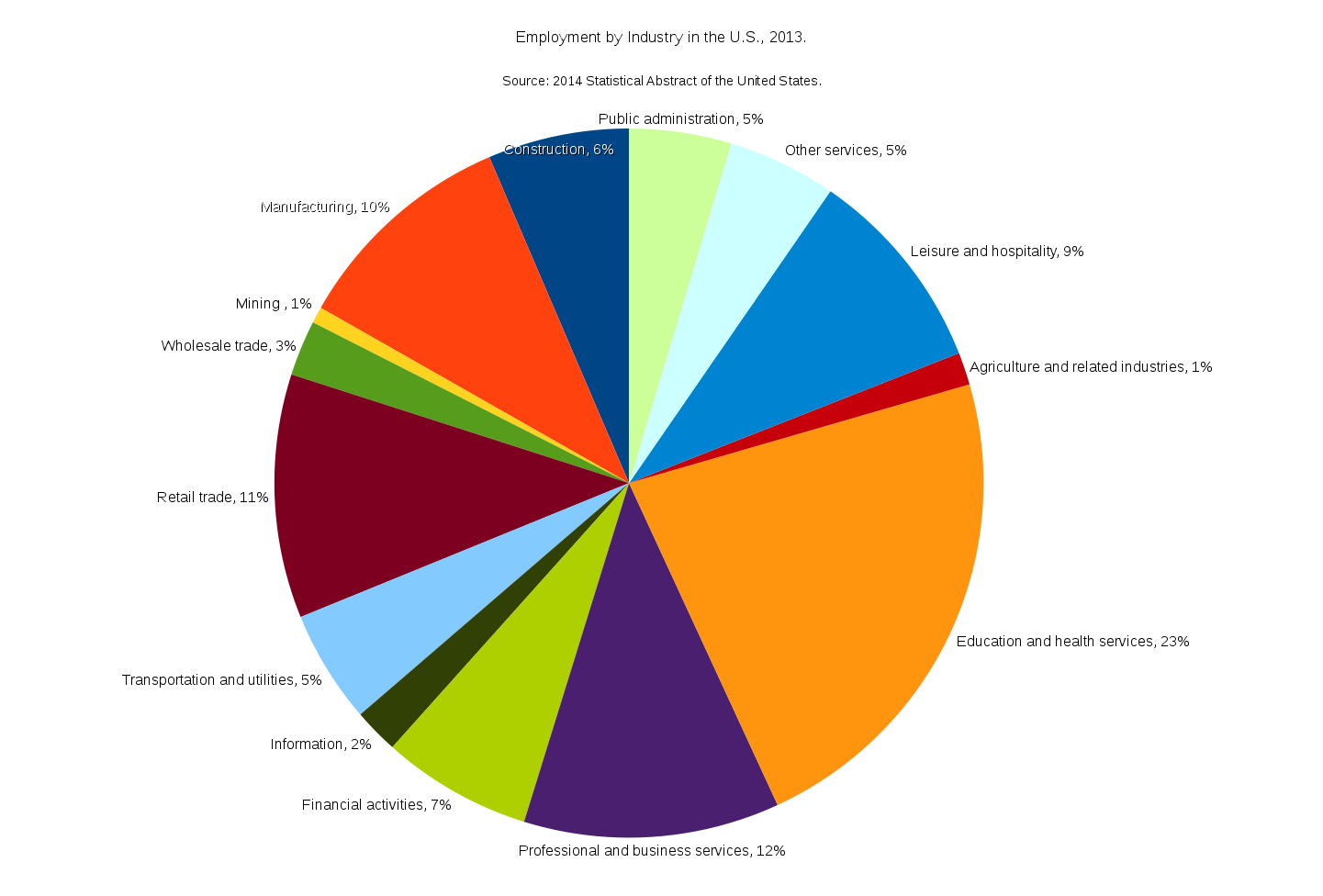

You can get easily get exposure to certain sectors

We have mentioned a couple of the S&P 500 ETF trackers above but there are a huge range of ETFs out there that will track certain indexes, sectors, markets, or asset classes.

Let's say you feel bullish about pharmaceuticals in general but don't know which company will produce the next blockbuster drug. No problem - just buy a pharma ETF like the SPDR S&P Pharmaceuticals (XPH) which tracks the S&P Pharmaceuticals Select Industry index.

If you don't have exposure to fixed income or an overseas market like the UK, then you could look at a fixed income or FTSE 100 tracker ETF. The options are almost endless!

Advantages of ETFs #6

You can still earn dividends

Many people ask if ETFs pay dividends? Well - the choice is yours! Many do.

Some ETFs will just use the income to reinvest back in the fund. Everyone's preferences are unique to them but the option to have dividends paid from ETFs are there for you.

Possibly the ultimate dividend payers are the dividend aristocrats. These are companies that are members of the S&P 500 index who have increased their dividend for at least 25 consecutive years. Guess what - there is an index of these dividend aristocrats and there are ETFs that track this index such as the ProShares S&P 500 Aristocrats ETF (NOBL).

Other examples of dividend paying ETFs include:

Take a look at our related articles on Dividend-paying ETFs, ETF dividend yields, and Monthly Dividend paying ETFs.

Advantages of ETFs #7

There are some serious tax advantages

One of the main advantages of ETFs is with capital gains tax.

If you own a single stock and you sell it or it is taken over, then a capital gain is realized and you are liable for the tax. Even if you invest in a mutual fund, you will be liable for capital gains taxes for companies sold within the fund. This eats into your returns. With an ETF, however, you only pay the capital gains tax when you sell your ETF. This means those gains can compound up tax free until you decide to sell that ETF.

The dividends from an ETF are similar to an individual stock. For US investors, there are qualified and unqualified dividends and, to be eligible for the qualified dividend, you need to hold the ETF for at least 60 days. Dividend tax rates depend on your individual tax rate but are generally more lower than income taxes.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.