Dividend Yield Calculator

Comparing dividends is a snap with our Dividend Yield Calculator below. Simply...

- Enter the amount you've received per share in dividends

- Select whether the dividend is paid monthly, quarterly, semi-annually or annually*

- Enter the stock price.

- Hit "Calculate"!

|

Dividend Calculator |

* The calculator assumes that an equal dividend is paid each month / quarter etc. If your stock pays varying amounts, total up the payments you've received throughout the whole year and enter it as an annual dividend.

Using a dividend yield calculator like this makes researching new stock investments much easier, as the dividend yield is one key indicator of whether this company offers good value for you. Of course, it's not the only measure you should consider, as many companies favour increasing their stock price above paying dividends (see our article on share buybacks for more info on this).

A couple of dividend yield calculator examples

Using the calculator, let's see which company offers a better return at current prices... the technology heavyweight IBM or Coca-Cola Corporation?

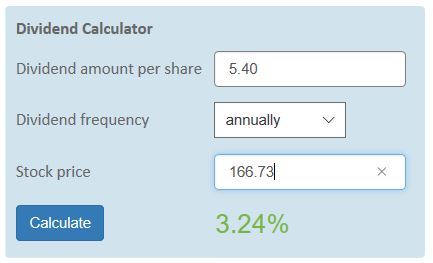

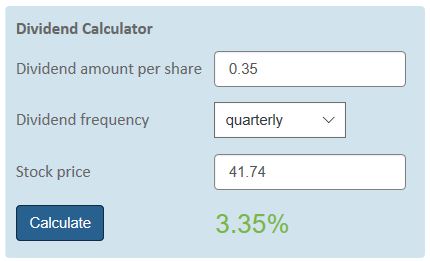

At today's price (Dec 18, 2016), IBM's stock price is $166.73 and Coca-Cola's $41.74.

IBM paid quarterly dividends of $1.40, $1.40, $1.30 and $1.30 in the last 12 months while Coca-Cola paid )$0.35, $0.35, $0.35 and $0.35.

Here are the outcomes when you plug the figures into our dividend yield calculator:

IBM (NYSE: IBM) IBM (NYSE: IBM) |

Coca-Cola Corp (NYSE: KO) Coca-Cola Corp (NYSE: KO) |

With such different stock prices, it's not easy to tell at first glance which offers the better return, but the answer is clear once you've keyed the figures in.

Coca-Cola offered a slightly better dividend yield.

Appreciating dividends - how to earn 5-10 times your initial outlay... each and every year!

What is also useful (and fun!) to do is to input the current dividends against the (average) stock price you paid for your holding.

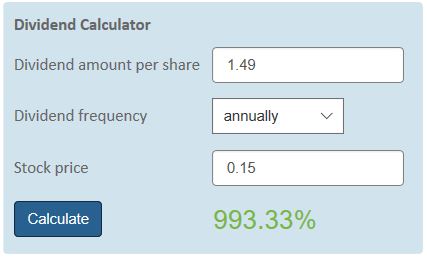

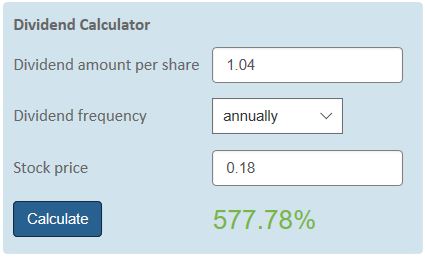

This kind of dividend growth is the magic of value investing. For super successful companies, annual dividends per share can outstrip the purchase price you paid, after a significant period of time.

For two examples of this, read on our Case Studies for the Walt Disney Corporation and British conglomerate Unilever.

In these examples the stock was purchased 50 years previously in 1966, and here's how their dividend yield calculations look, using the purchase price paid taking into account share splits:

The Walt Disney Co. (NYSE: DIS) The Walt Disney Co. (NYSE: DIS) |

Unilever (LSE: ULVR) Unilever (LSE: ULVR) |

Yep, you read it right, if you had bought and held Disney stocks since 1966, you'd receive nearly 10 times your initial investment every year - and that's without re-investing the dividends you'd have received up to that point.

Similarly for Unilever, over the same time period, you'd earn more than 5 times the initial outlay every year, again without dividends reinvested.

Not bad for a buy and hold strategy!

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.

What Other Visitors Have Said

Click below to see contributions from other visitors to this page...

Calculating $ Dividends from ETFs

I know exactly how much my cash dividend will be from an individual

stock...x number of shares x $ am't. Simple. But how do I know how much

I'll earn …