How important is a company's dividend history?

|

|

How important is a company's dividend history? Supposing I'm considering investing in a stock, would you advise me to place much importance on the amounts paid out in previous dividends? In other words, do companies which pay strong dividends generally continue to do so? |

|

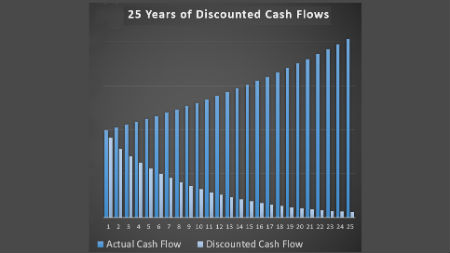

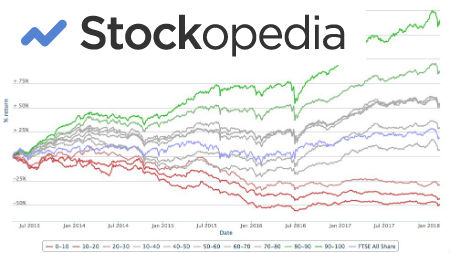

The dividend history of a company is not a bulletproof way of assessing how the company will pay out in the future but it can be used to give you clues. Remember that ultimately dividends must be paid from earnings and sustainable cashflow, so you must be sure to check out both the earning power and cash generation abilities of the company before investing for the dividends. As we discussed in our article on dividend aristocrats, the management of companies that have consistently been raising their dividends for years and years are going to have a huge focus on continuing this trend. Shareholders would be asking some very serious questions if these management teams were to cut (or even freeze) the dividend payment. Dividend policies are often spelled out by management. They will often talk about their priorities for the free cash generated by the company and may indicate how much of that they will look to pay out and how much they will re-invest in the business. The way to gain these insights is to read some of the documents released by businesses such as the quarterly filing or the annual report (available in the investor relations sections of the company's website - see below for more on this). The more of these you read, the more experienced you will become in judging how generous you can expect management to be in the future. At the end of all this, however, do not forget that the past is not a reliable predictor of the future. It can at best be considered a clue to future performance. |

|

|

|

How do you find a company's dividend history?Can you take me through a specific example, please... Wells Fargo for instance? |

|

Sure. The first calling point is that company's website. For Wells Fargo, you could go to their site and find their payment history back to 1995 at http://www.wellsfargo.com/about/investor-relations/stock-price-and-dividends/ If you want to compare different companies or get quick data on various companies then you could use specific stock screeners. There are numerous websites that give a wealth of information on the past dividend payouts and other fundamental information. For the very best quality sites, such as ValueLine.com, then you should expect to pay but some sites such as the Google finance site will give you some financial history. Just search for the company you're looking for and then click on financials. This allows you to see all the headline figures for a company including the dividend history. Whilst dividend history is undoubtedly important in gauging how good management have been in allocating their capital in the past what matters to you, as an investor, is the future. Knowing what has been paid out to investors in the past is important but don't let it cloud your judgement about future payments. |

|

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.