Choosing an ETF - advice please!

|

Mike, I'm choosing an ETF to try to spread my exposure to as many different stocks and markets as possible. My plan is to park a portion of my investment funds into this from the start of my investment and each month thereafter, but I've been overwhelmed by the number of ETF funds out there. Choosing an ETF was going to be my "easy" option, but I'm not sure which one to go with. What advice is relevant here? Specifically:

|

|

|

Choosing an ETF can be very intimidating and knowing where to start is often the hardest part. The most important thing is to decide how much "exposure" you want to the market in general (checkout our page on savings or stocks for help) and whether there are any particular sectors or geographies that you'd like to invest in. There are several advantages of ETFs and they can be particularly useful to investors with smaller portfolios who are unable to build up a diversified enough portfolio through single stocks or if you are unable (or unwilling) to do some of the legwork yourself - we don't blame you as most people have other things to do in their life! I'll address your questions about choosing an ETF below: 1. How do you work out the investing criteria of these funds?

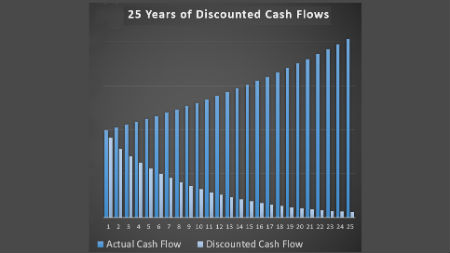

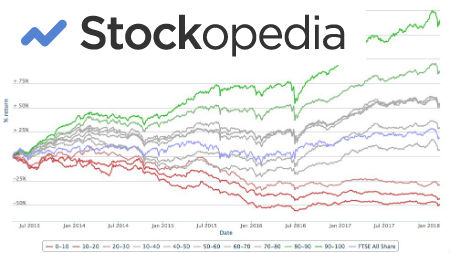

Many ETF's goal is to make index investing cheaper. So if you were to buy an ETF that has the goal was of tracking the S&P 500, then your returns should mirror (minus costs) the S&P 500 index. Any deviation from the underlying index is known as tracking error and can be researched from the ETF provider's website. The funds track these indexes by trying to weight their fund holding to the same weightings in the S&P 500 index. So, at the time of writing, the largest stock in the S&P 500 is Apple with a weighting of just over 4% of the index. Therefore, if you were to buy a S&P 500 tracker ETF then you are effectively putting 4% of that cash into Apple stock. You can find the latest S&P 500 components here. Of course, ETFs come in many shapes and sizes and when you are choosing an ETF you should look for an ETF that fits your goals. For example, imagine that after the banking crash of 2007-2009 you thought that banking stocks must be cheap and due a rebound. The problem was that you weren't sure which banks might wipe you out because it was impossible to tell how good their assets really were. Therefore to bet on the sector, you decide to purchase an ETF that tracks banking sector stocks. This would then help you make a bet on a sector without knowing which particular banks would recover and do well. You can find a list of good potential financial ETFs here. To help you in choosing an ETF then you may want to use a filter to narrow your options. A good start would be looking at a page like this from ETF.com. 2. Is past performance the clearest indicator of the likelihood of future profits when choosing an ETF?

Have you not heard the typical financial disclaimer! "Past performance is not indicative of future results". SEC rule 156 actually demands that mutual funds state this. It is true as well! So the reality is that your returns will not match past performance and this is especially the case in the short run. It can be very dangerous just to go and buy the latest hot stock or sector as you could easily be buying into a bubble that ends up badly. Instead, look for good quality at a reasonable price. For this, you need to check out the fundamentals (underlying strengths) that back the investment. Over a very long period of time you'll probably find past performance will give you a clue. Over most 30 year periods in US stock market history average anualized real returns from US stocks has been 5.5% per year. Of course this isn't guaranteed in the future but we'd expect a group of stocks to do fairly well over a long period of time. 3. If not, what else should I consider?

You should just stick to what you understand. If you don't like the volatility of stocks (they will be volatile!) then go for other asset classes. Most people find real estate easier to understand as it is "tangible." Otherwise you could consider bonds, private businesses (or franchises), or building your own assets such as royalties or trademarks. The opportunities are endless! |

|

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.