Unilever Stock Case Study 1966-2016

Take a look at this Unilever stock case study to see just what long term dividend investment can do for your wealth...

Does a buy and hold strategy really pay off?

The answer in a word is: "Yes".

|

I recently went to stay with my Grandfather and we were talking about the stock market. This led to him showing me the ledger he's kept all his investing life. It was fascinating to see a lifetime of investments, but what really caught my eye was his investment in Unilever the British/Dutch consumer goods giant. On 1st August 1966, he purchased 700 Unilever shares at a price of 29 shillings and 6 pence. In the language that we use today, that equates to around £1.47. This means the cost to him was £1,032 plus £24 of expenses (dealing costs in those days were very high compared to today). Plugging £1,056 into an inflation calculator shows me that this is the equivalent of £18,480 today. In 1985, Unilever did a 5 for 1 stock split, then another 4 for 1 split 1997. There was then a 25 for 28 share consolidation in 1999, and a further 9 for 20 consolidation in 2006. So the original 700 shares have now turned into 5,625 shares. |

|

Unilever stock case study: The figures:

|

1966 |

700 shares purchased |

=700 shares |

Today (19th September 2016) the share price for Unilever is £35.17. This means that original £1,056 purchase is now worth 35.17 x 5,625 = £197,831.25.

Not bad at all!

At no stage has my Grandfather reinvested the dividends or bought any more shares. He has just sat on those shares and got on with his life as Unilever sold their washing detergent, soap, ice creams etc.

What would you be earning today if you'd invested at the start of this Unilever stock case study?

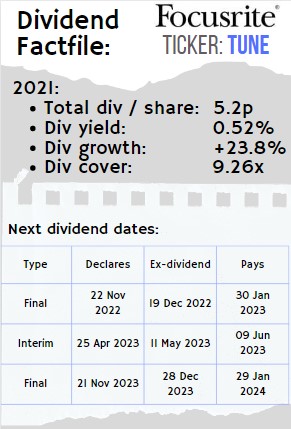

Over the last year Unilever has paid £0.9804 per share in dividends, so those original shares now pay £5,515 PER YEAR in dividends (and growing!). That is more than five times the original investment.

I don't have dividend data for Unilever going back to 1966 but if we strip out the dividends, the capital return for my Grandfather is over 11% a year.

As all readers of this website know though, we can't possibly ignore the dividends. My best guess is the average yield over all those years was in the 3-5% range, so that could be added to the per annum return.

The good news is that I can find dividend records going back to 1988. If we adjust for the splits and consolidations, and include special cash distributions, I calculate that Unilever have paid the equivalent of £ 13.49 of the current shares in dividends since May 1988. On 5,625 shares, that equates to another £75,881.25 on those original shares and completely ignores his first 22 years of holding Unilever.

My Grandfather just spent those dividends. There is no problem with that - it is always an individual choice but it is difficult to even imagine how valuable that original stake would be if he had been reinvesting dividends along the way. What we can learn from this, though, is what Warren Buffett often preaches. Time is the friend of the great company and there are certain stocks out there that are just gifts that keep on giving.

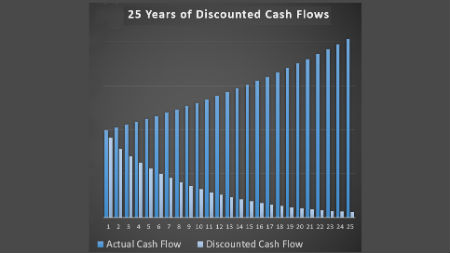

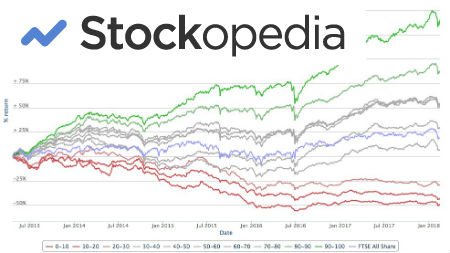

So in summary, researching and buying companies that pay good and sustainable dividends and then holding those investments for long periods of time means you can let the compounding do the heavy lifting for you.

For other articles similar to this Unilever stock case study, see our Case Studies section!

For Unilever investor relations page, click here.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.

What Other Visitors Have Said

Click below to see contributions from other visitors to this page...

More reinvested shares

2002 started reinvesting dividends with Diageo 900 shares & BAT 1300 shares, do you think that was an equally good opportunity as the Unilever one??

Uni lever shares

If I had 4000 unilever shares in 2002 adjusting for the 20/9 share restructure and taking into account I re invested my dividends into new shares as a …